AB Capital Short-term Fund

The Fund aims for capital preservation and income generation by investing in a diversified portfolio of fixed income instruments with a maximum portfolio duration of one (1) year. The Fund aims to surpass its benchmark (gross of fees) equivalent to 3-month PHP BVAL reference rate (Bloomberg Code: BV3MRPTB). This benchmark is interpolated by the levels 3-month PHP government treasury bills trade using Bloomberg's proprietary model. The BV3MRPTB rate is then accrued daily to serve as the fund's benchmark on a net of tax basis (less 20% withholding tax).

Fund Name

Fund Class

Risk Profile

Minimum Initial Investment

Minimum Maintaining Balance

Equity Exposure Limit

Benchmark

Minimum Holding Period Redemption Settlement

Trust Fee

AB Capital Short-term Fund

Money Market

Moderate

Php 50,000

Php 50,000

0%

3M PHP BVAL

None

T+1

0.375% p.a.

Amended Declaration of Trust (DOT)

Annual Financial Statements (AFS)

Key Information and Investment Disclosure Statement

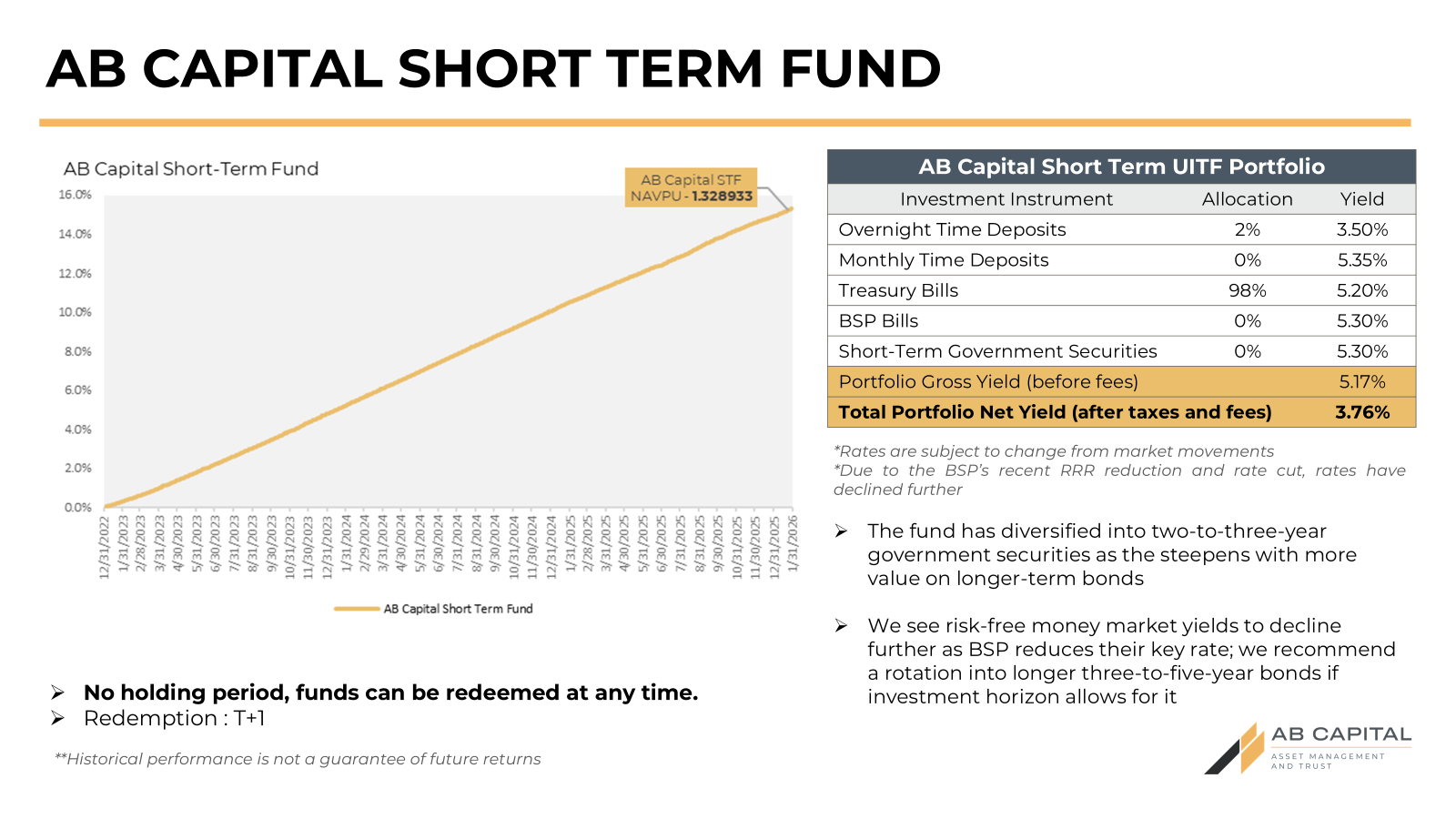

Fund Performance

As of February 19, 2026

NAVPU

YTD

Benchmark

YOY

AB Capital Short-Term Fund

1.332252

0.65%

0.36%

4.41%

Historical results are not indicative of future performance. AB Capital UITFs are products subject to BSP regulations and are not deposit accounts. Therefore, yields, returns or income are not guaranteed and not insured by the Philippine Deposit Insurance Corporation (PDIC). Any income or loss is for the account and risk of the investors. The trustee shall not be liable for any losses, except upon willful default, gross negligence, fraud or bad faith. The Declaration of Trust governing the funds is available upon request. UITFs have varying levels of risk. Investors are advised to match their risk profiles with the appropriate UIT63

Short-term Fund vs Benchmark

As of January 31, 2026